LAWS3101 Notes Topics 1-9 (everything)

Subject notes for UQ LAWS3101

Description

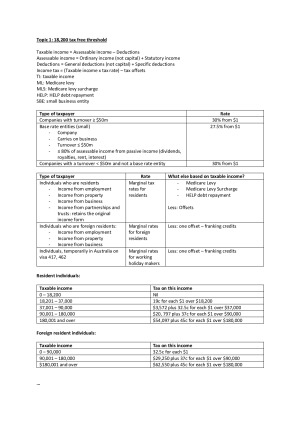

Notes for the whole LAWS3101 course. Get it cheaper here instead of buying it separately! Topics: - Topic 1: The taxation system in Australia - Topic 2: Residence, source and tax accounting - Topic 3: Income - Topic 4: Deductions - Topic 5: Trading stock - Topic 6: CGT - Topic 7: Partnerships and trusts - Topic 8: GST - Topic 9: FBT Includes: - Topic 1-3 lecture summaries - Topic 1-9: > Required textbook reading notes > Study note summaries > Case law and relevant ITAA sections: Please note that within some topics, case law was not assessable for Semester 1, 2019 ( Topic 1, 6, 8 and 9)

UQ

Semester 1, 2019

40 pages

17,281 words

$49.00

20

Campus

UQ, St Lucia

Member since

February 2017