LAWS3412 Australian Income Tax Law - (DISTINCTION) - In-person Exam (2023) SUMMARY Notes / CHEAT SHEET (MID-SEM & FINAL EXAM)

Subject notes for USYD LAWS3412

Description

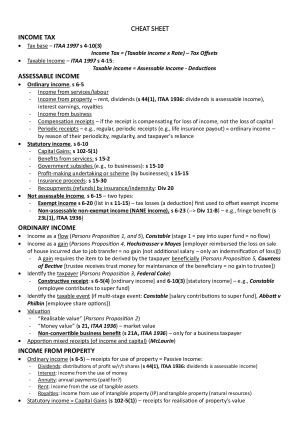

Excellent Final Exam summary notes prepared by a DISTINCTION student!! - includes BOTH MID-SEM & FINAL EXAM materials!! Perfect for in-person written exam!! Super concise and easy to follow!! Very very useful in the final exam!!! Topics 1) Introduction to Tax and the Australian Tax System 2) Concepts of Income 3) Income from Property and Capital Gains Tax 4) Income from Services and Fringe Benefits Tax 5) Business Income 6) Deductions – Relevance 7) Deductions – Trading Stock (business taxation) 8) Deductions – The capital/revenue distinction 9) Deductions – Depreciation (business taxation) 10) Entity Taxation: Partnerships, Trusts, and Companies (Imputation) 11) Goods and Services Tax 12) Tax Administration 13) Ethical conduct and rules to counter tax avoidance

USYD

Semester 1, 2023

21 pages

13,500 words

$34.00

10

Campus

USYD, Camperdown/Darlington

Member since

February 2019

- FASS2300 Asian Economic Community - HD (99) 1st Place - SUMMARY Notes

- LAWS2011 Federal Constitutional Law - HD Final Exam Notes + Scaffolds + Summaries (1st place)

- LAWS2011 Federal Constitutional Law - HD Final Exam SUMMARY Notes (1st place)

- LAWS2011 Federal Constitutional Law - HD (1st place) FULL NOTES + SCAFFOLDS (ALL TOPICS)

- LAWS2018 Private International Law A – (DISTINCTION) Detailed FULL NOTES + SCAFFOLDS (ALL TOPICS)